Income Tax Calculator

Calculate your income tax for FY 2025-26 (AY 2026-27) - Budget 2025

Tax Calculation

✨ Tip: Income up to ₹12.75 Lakhs is tax-free for salaried employees (incl. Standard Deduction).

You save ₹59,800 with the New Regime compared to the Old Regime.

Taxable Income

₹1125000

After deductions and exemptions.

Total Tax

₹0

Includes surcharge and cess.

Net Income

₹1200000

Take-home after total tax.

Effective Tax Rate

0%

Tax as % of gross income.

Income Breakdown

Tax Distribution

Tax Slab Breakdown

| Income Slab | Tax Rate | Taxable Amount | Tax |

|---|---|---|---|

| ₹4,00,000 - ₹8,00,000 | 5% | ₹400000 | ₹20000 |

| ₹8,00,000 - ₹12,00,000 | 10% | ₹325000 | ₹32500 |

| Section 87A Rebate | N/A | ₹52500 | -₹52500 |

| Surcharge | Tiered | ₹0 | ₹0 |

| Health & Education Cess (4%) | 4% | ₹0 | ₹0 |

Regime Comparison

| Metric | New (Current) | Old (Alternate) |

|---|---|---|

| Total Deductions | ₹75000 | ₹475000 |

| Taxable Income | ₹1125000 | ₹725000 |

| Total Tax | ₹0 | ₹59800 |

| Net Income | ₹1200000 | ₹1140200 |

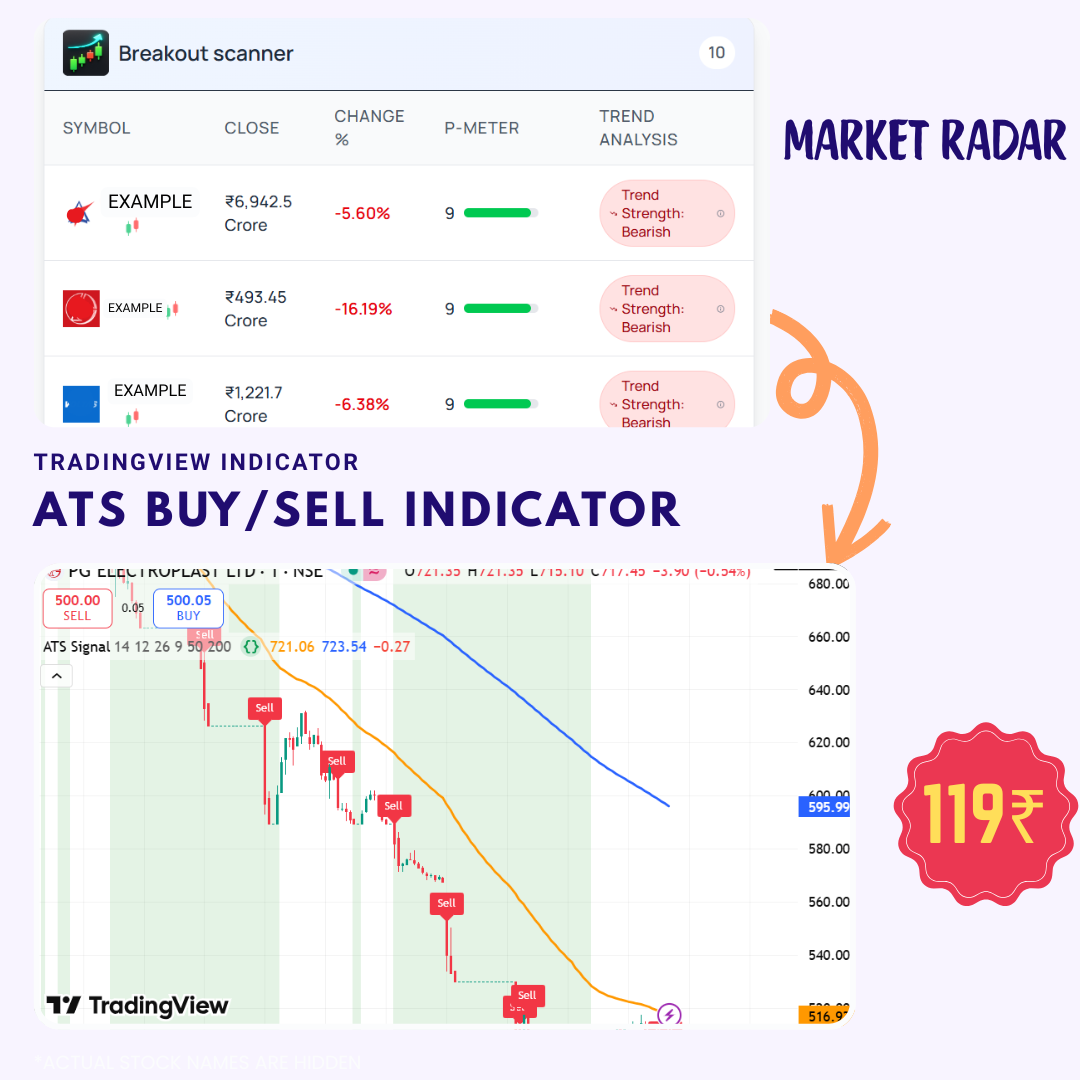

Trade with Confidence

ATS buy/sell signal indicator - for NIFTY,SENSEX,CRUDE OIL,XAU USD, BTC USD, ETH USD and more charts on tradingview